November 30, 2021

The Big Mac Index in 2021

Entertaining

Who hasn't tried or at least heard of a famous Big Mac at McDonald's fast-food restaurants? However, few people know that it gave rise to the so-called Big Mac Index, which compares the value of currencies of different countries.

The Big Mac Index in 2021

Olga Protska Senior Content Writer & 2D Artist

What is the Big Mac Index?

The Big Mac Index is the price of the burger in various countries that are converted to one currency (such as the US dollar) and used to measure purchasing power parity.

It all started in 1986 when The Economist magazine decided to estimate the currencies' value by country based on the prices of Big Mac at McDonald's fast-food restaurants.

Thus, The Economist introduced a simple indicator of the fundamental value of currencies globally.

What does the Big Mac Index show, and why exactly was it taken as an indicator?

It's pretty simple. Big Mac is the most well-known product in McDonald's' fast-food chain. Besides, the same ingredients are used for Big Mac in any country: meat, bread, cheese, lettuce, onions, etc. Therefore, The Economist experts use Big Mac alone instead of determining the cost of a consumer basket (more complex method) for each country.

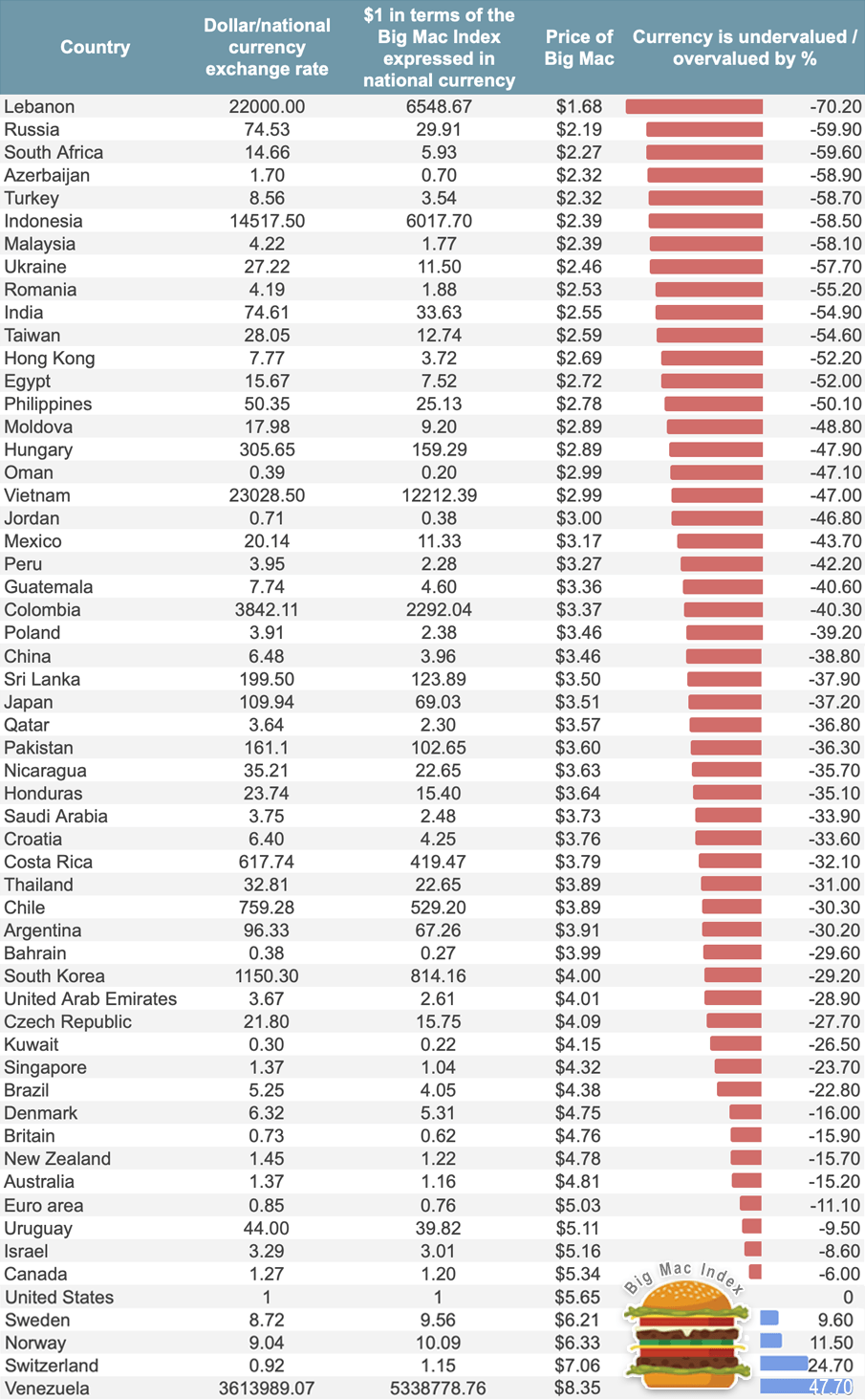

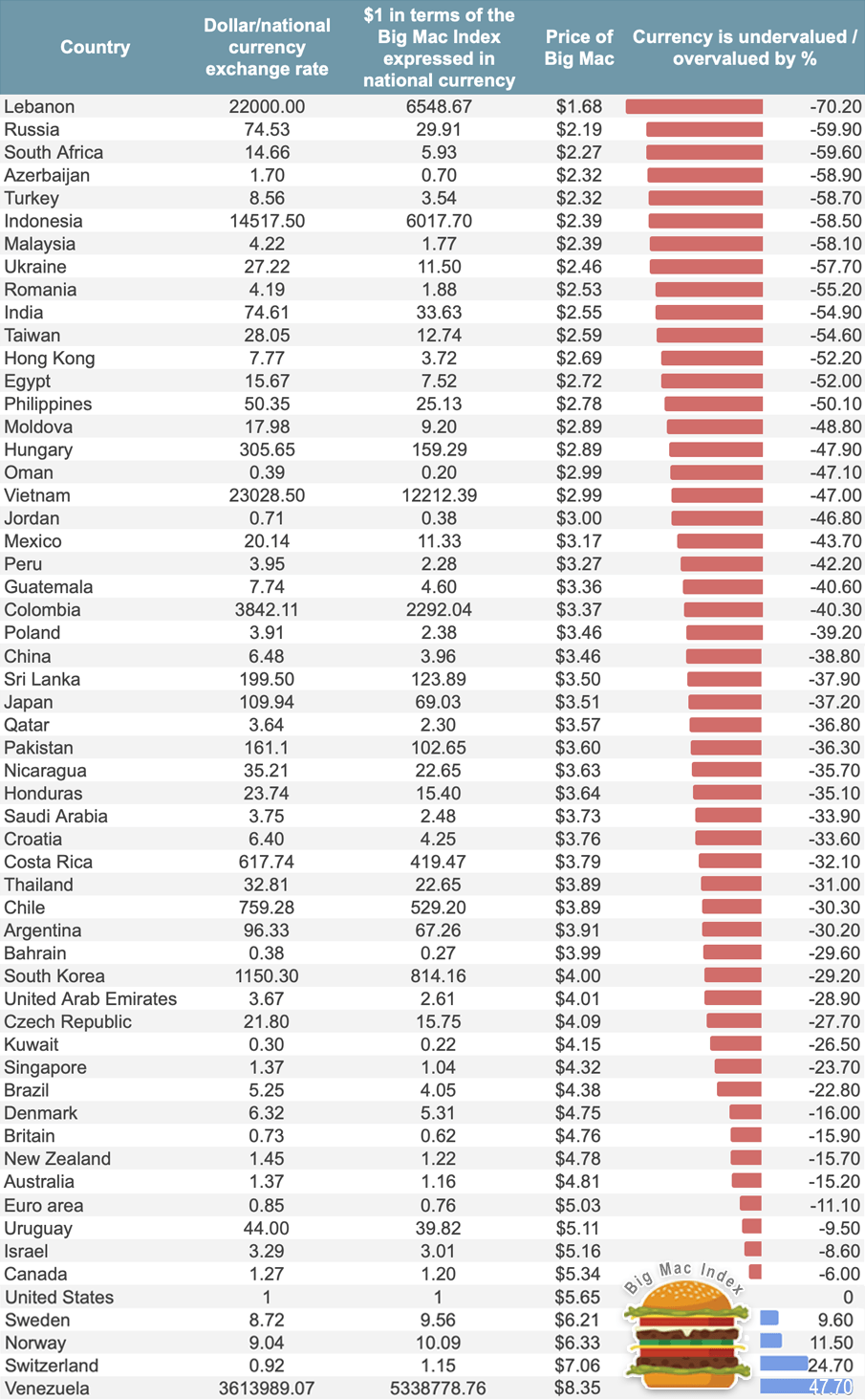

Big Mac Index Table as of Q3 2021

The most relevant Big Mac Index so far (as of July 2021) is presented in the table below.

Let's analyze these data a bit.

The Lebanese pound exchange rate expressed in the Big Mac Index in July 2021 is 6548.67 pounds per dollar.

Considering that the current market rate of the Lebanese currency is about 22000 pounds, rather than 6548.67 per US dollar, the pound is undervalued by approximately 70.20%.

Thus, the Lebanese pound is the world’s most undervalued (cheapest) currency according to the Big Mac Index.

In 2019, the Russian ruble was the most undervalued (by 64.5%) currency worldwide.

Now, Big Mac costs $2.19 in Russia. While the price of the burger in the United States is $5.65, the Russian currency exchange rate is 29.91 ruble per dollar in terms of the Big Mac Index.

However, the ruble is cheaper in Forex – about 74.53 rubles per US dollar (as of July 2021). Therefore, we can conclude that the market undervalues the Russian currency by almost 59.90%.

In the list of the world’s most undervalued currencies, the Russian ruble and the Lebanese pound are accompanied by the South African rand (undervalued by 59.60%), Azerbaijani manat (undervalued by 58.90%), and the Turkish lira (undervalued by 58.70%). Notably, the currencies of India, Pakistan, the Philippines, and other low-income countries are not in the top five most undervalued currencies in 2021.

As for the most highly valued currencies, the statistics by countries show that the world’s most overvalued (expensive) currency is the Venezuelan bolívar.

As of July 2021, the Big Mac costs 30,164,100 bolívares in Venezuela or $8.35, making it the most expensive Big Mac in the world. The exchange rate based on the Big Mac Index is supposed to be 5,338,778.76 bolívares per US dollar. Although, the actual VEF/USD rate is approximately 3,613,989.07, making this currency overvalued by 47.70%.

Switzerland, Norway, and Sweden accompany Venezuela as the most overvalued currencies based on the Big Mac Index.

According to the Big Mac Index authors, Euro is also undervalued by the market. The average Big Mac price in the Eurozone is $5.03, meaning the currency is undervalued by 11.10%.

Notably, according to the Big Mac Index, all major currency pairs, except the Swiss franc, Swedish krona, and Norwegian krone, are undervalued against the US dollar.

Can We Use This Knowledge in Trading?

We can hardly do it in the short and medium terms, but the Big Mac Index can serve as a helpful assistant while long-term trading.

For example, it can be used as a filter when opening positions in the Forex market. After all, if the Japanese yen is significantly oversold against the US dollar, traders should refrain from opening long positions on USD/JPY.

We can draw similar conclusions for other Forex currency pairs.

The key thing to remember is that the Big Mac Index is an accurate indicator of the fundamental value of currencies, and traders can benefit from its use in trading.

Reply With Quote

Reply With Quote